CONTACT US

AGENT PORTAL

We are seeking motivated individuals that want to make an impact in the lives of families.

We build leaders.Join us today.

We help families across America.

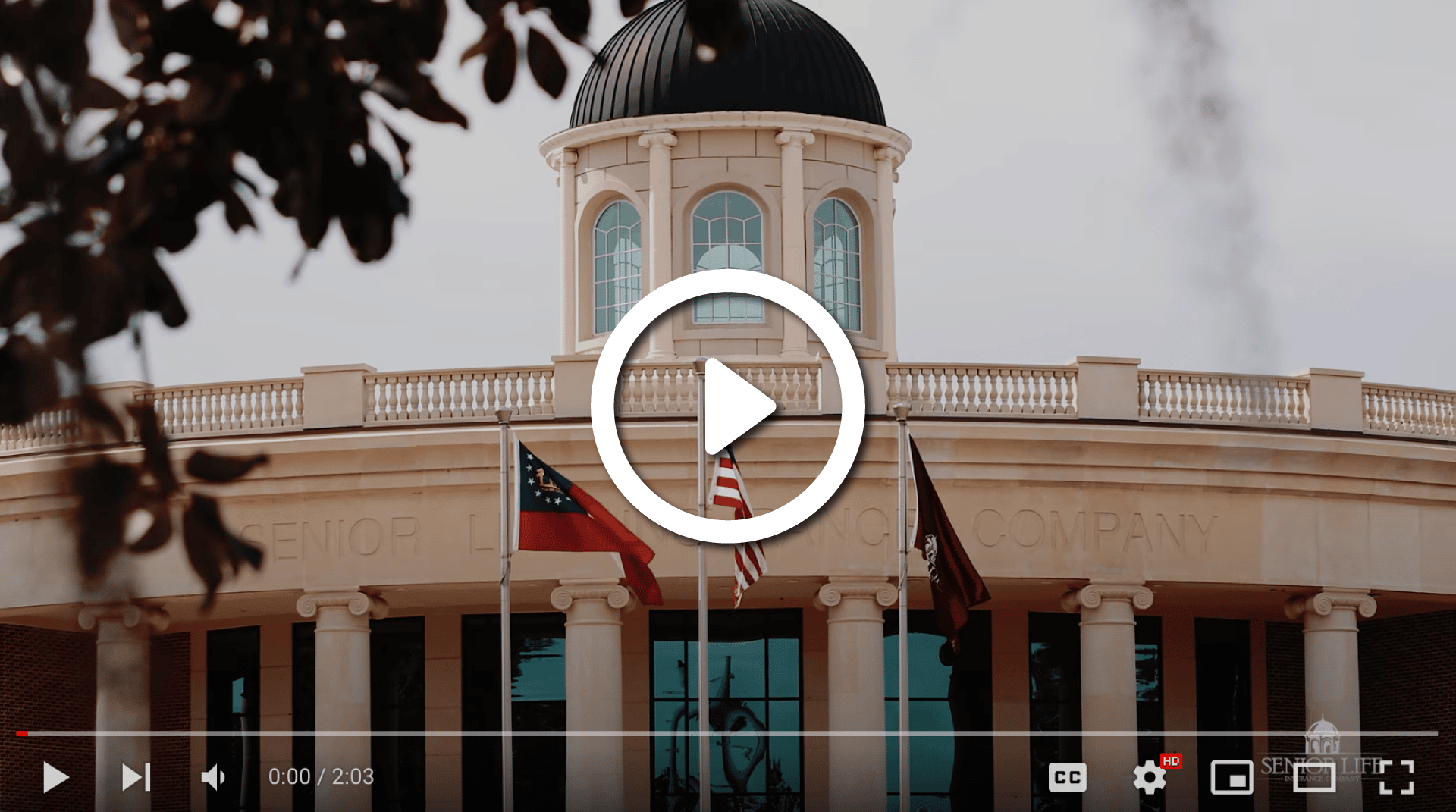

Established in 2000, Senior Life Insurance Company serves people by providing affordable final expense products and legendary customer service to our policyholders, agents, partners, and employees as we become the largest final expense company in the United States. As part of our Home Office staff, you will have the opportunity to grow your talents, develop new skills, and make an impact in the lives of others. We help thousands of policyholders and agents every day.

Interested in a position with us? Check out our open roles.

Why should you join our team?

At Senior Life Insurance Company, along with the opportunity to grow your talents & develop new skills. we also offer incredible benefits.

Many of our Home Office staff are licensed life insurance agents, today!By selling once a week, you’ll be able to earn bonus money.

We’re hiring for Home Office positions in Thomasville, GA.

Open Job Positions

We're currently hiring recruiting liaisons.

Recruiting Coordinator

We are looking for a talented Recruiting coordinator with full cycle recruiting experience to join the Senior Life Insurance Team. The coordinator will be responsible for submitting job postings, attracting potential agents both licensed and non-licensed, evaluate resumes, schedule, and conduct interviews and placing candidates with agencies. This candidate should be able to attract potential candidates using various job posting sources. As a recruiting coordinator, you will have thorough knowledge of the products sold by Senior Life Insurance Company, the company culture and have innovative ideas. If you have strong communication skills and are looking for a company to grow with, we want to meet you.

Job Type: Full Time

Qualifications:

- Recruiting experience: 1 year (preferred)

- Customer Service: 1 year (preferred)

- US work authorization

- Computer skills (basic)

- Problem solving skills

Responsibilities:

- Handling recruiting

- Working closely with top level agents and executives

- Posting job ads

- Communicate daily with potential agents and agencies

- Occasionally assist in company meetings and events

- Other job duties as assigned

Interested in applying? Click here.

We're currently hiring creative designers.

Creative Designers

Our creative designers consist of digital marketing, graphic designers, social media coordinators and videographers. The ideal candidate will be responsible for collaborating with the creative team to concept, produce and launch marketing projects together. The designer will also be responsible for creating content for all marketing touch points, defining Senior Life’s brand identity and ensure high quality and consistency.

Job Type: Full Time

Responsibilities:

- Collaborate with creative partners to concept and create new projects

- Work across a number of creative projects simultaneously, maintaining standards and supporting the other creative team members

- Acting as both an individual contributor and a team player to execute our creative strategy, working with internal employees and liaising directly with artist partners

- Delivering results by working with both internal and external resources

- Other job duties as assigned

Interested in applying? Click here.

Qualifications:

- Experience creating digital campaigns

- A confident and persuasive approach to creative projects

- Excellent written and oral communication skills

- Full awareness of creative processes, techniques, and trends in the design industry

- Excellent working knowledge with Photoshop, Illustrator, InDesign on Mac operating System is essential

- A design, marketing, communications, or business degree would be of distinct advantage

Positions:

- Graphic Designer

- Social Media Coordinator

- Digital Marketer

- Videographer

- Web Designer

- Copywriter

- Communications specialist

Interested in applying? Click here.

We're currently hiring market compliance officers.

Market Compliance Officer

Senior Life Insurance Company is searching for a creative, resourceful, and integrative thinker to join the market compliance team. In this role, you will be assisting our legal/compliance team with researching state and federal guidelines to ensure our company is compliant in each state we sell in. The ideal candidate will be comfortable working independently or with a team on projects, excellent written and verbal communication skills, and be able to solve problems in a professional and timely manner.

Job Type: Full Time

Responsibilities:

- Assisting Legal/Compliance team in implementing our Compliance Management System and Compliance Risk Management Framework

- Resolving discrepancies

- Researching state and federal regulations and procedures

- Working with company leaders on team projects

- Communicate with industry professionals

- Other job duties as assigned

Qualifications:

- Superior organization skills and ability to multi-task are a must.

- Strong written and verbal communication skills required.

- Excellent problem resolution skills.

- Ability to work in fast-paced environment and meet deadlines.

- Ability to work with minimal supervision.

- Detail-oriented and self-motivated with the ability to proactively identify issues.

- Proven ability to work well with and coordinate with others.

Interested in applying? Click here.

We're currently hiring accounting analysts

Accounting Analyst

We are seeking a motivated, qualified individual to join the Senior Life Insurance Family. As part of our finance team, you will collaborate with financial compliance, operations, and directors to perform regular duties for all company finances, such as forming a view of our current assets, expenditures, and billing. Our ideal candidate has a bachelor's degree in finance and prior professional experience in a corporate accounting environment.

Job Type: Full Time

Duties & Responsibilities:

- Assist policyholders and agents as required

- Process loans, surrenders, death claims, refunds, and other accounting duties

- Process daily billing and cycle

- Assist with month -end and year-end duties

- Other job duties as assigned

Requirements & Qualifications:

- Bachelor's degree in finance or related field

- Prior experience in a corporate accounting environment

- Excellent communication, analytical, and organizational skills

- Mathematical proficiency

- Ability to work in a fast-paced environment

- Meet deadlines in a timely manner

Interested in applying? Click here.

We're currently hiring customer service representatives.

Customer Service Representatives

As one of the leading final expense companies in the nation, Senior Life Insurance Company is passionate about giving the best service to our customers. As a customer service representative for Senior Life, you will be given the opportunity to help families and agents on a daily basis. The main responsibility of our Customer Service Representative is to provide an exceptional customer service experience in a timely manner for clients of Senior Life Insurance Company. The position offers an opportunity for individuals to grow within the industry and establish a long-term career with a nationwide company.

Job Type: Full Time

Responsibilities:

- Provide a personalized experience for every single client through product expertise and outstanding service

- Have a thorough understanding of Senior Life Insurance Company products and services

- Keep records of customer interactions, process customer accounts and file documents

- Manage all phases of the client experience from initial contact through delivery

- Represent our brand through communication, personal appearance, and professionalism

- Build sustainable relationships of trust with clients through open and interactive communication

- Other job duties as assigned

Basic Qualifications:

- In-office work environment

- Industry experience is a plus but not a requirement, we provided training

- High school diploma

- Bilingual is a plus

- Excellent communication skills, including the ability to communicate internally and externally

- Excellent computer proficiency

- Ability to meet deadlines in a timely manner

Interested in applying? Click here.

We're currently hiring licensing coordinators.

Licensing Coordinators

The licensing team at Senior Life Insurance Company ensures that the best services to our agents and agencies. The daily role of a licensing coordinator is to verify agent backgrounds, field inbound and outbound agent calls, maintain agent paperwork and create an unforgettable customer service experience for new and existing agents.

Job Type: Full Time

Responsibilities:

- Inbound and Outbound calls

- Verify agent background

- Update agent information

- Manage commission levels for agents

- Reporting

- Process Senior Life of Texas

- Other job duties as assigned

Requirements:

- Excellent internal and external communication skills

- Efficient with computers and software

- Ability to work independently

Interested in applying? Click here.

We're currently hiring payroll analysts.

Payroll Analysts

We are looking for a Payroll Analyst to join our team!

Payroll Analyst responsibilities include reviewing payroll data and documents for inefficiencies and errors, checking whether all amounts are accurate based on hours worked ensuring payments are made on time, and checking payroll invoices from vendors. To be successful in this role, you should have excellent analytical skills with the ability to spot numerical errors.

Ultimately, you’ll help us maintain an efficient payroll process that complies with all federal and state regulations.

Job Type: Full Time

Responsibilities:

- Review timesheets and attendance records and correct inaccuracies

- Prepare and submit all necessary paperwork for tax deductions, benefits and garnishments

- Analyze compensation-related data including wages and bonuses

- Oversee payroll transactions (e.g. via e-banking)

- Conduct regular audits on payroll procedures and records

- Process benefit costs, like insurance fees and sick leaves

- Design, document and implement procedures to streamline payroll processes

- Manage payment calendars for the fiscal year

- Report to management on payroll issues and changes

- Answer employees’ questions about salaries and tax

- Stay up-to-date on state and federal payroll and tax laws

Basic Qualifications:

- Proven experience as a Payroll Analyst, Payroll Coordinator or similar role

- Deep knowledge of state and federal payroll and tax regulations

- Hands-on experience with payroll software

- Familiarity using Excel and spreadsheets

- Excellent analytical skills

- The ability to work under tight deadlines

Interested in applying? Click here.

We're currently hiring agent support representatives.

Agent Support Representatives

As one of the leading final expense companies in the nation, Senior Life Insurance Company is passionate about giving the best service to our agents. As an agent support representative for Senior Life, you will be given the opportunity to assist our field agents and agencies on a daily basis. The main responsibility of our Agent Support Representative is to provide an exceptional customer service experience in a timely manner for agents of Senior Life Insurance Company. The position offers an opportunity for individuals to grow within the industry and establish a long-term career with a nationwide company.

Job Type: Full Time

Responsibilities:

- Provide a personalized experience for every single client through product expertise and outstanding service

- Have a thorough understanding of Senior Life Insurance Company products and services

- Keep records of customer interactions, process customer accounts and file documents

- Manage all phases of the client experience from initial contact through delivery

- Represent our brand through communication, personal appearance, and professionalism

- Build sustainable relationships of trust with clients through open and interactive communication

- Other job duties as assigned

Basic Qualifications:

- In-office work environment

- Industry experience is a plus but not a requirement, we provided training

- High school diploma

- Bilingual is a plus

- Excellent communication skills, including the ability to communicate internally and externally

- Excellent computer proficiency

- Ability to meet deadlines in a timely manner

Interested in applying? Click here.

We're currently hiring claims analysts.

Claims Analysts

Our mission at Senior Life Insurance Company is to help people. Our claims analyst team works diligently to fulfill that promise to our policyholders every day. The role of a claim’s analyst is to review records, analyze cases, speak with family members, and correspond with medical professionals. The ideal candidate will be efficient with their internal and external communications, detail-oriented and driven.

Job Type: Full Time

Responsibilities:

- Reviewing medical records, billing statements, and other documents to determine if claims are eligible for payment

- Communicate daily with beneficiaries, agents, medical professionals, and other vendors

- Investigating discrepancies in processing claims, such as identifying fraudulent activities or making sure that all documentation is accurate and complete

- Processing claims for payment by verifying eligibility, calculating amounts due, and submitting them for approval

- Reviewing claims for accuracy and ensuring that they meet all legal requirements for filing with a state or federal agency

- Investigating claims to determine if an error has occurred in processing or adjudication of a claim

- Interpreting policies and procedures to ensure that claims processing is performed correctly

- Other job duties as assigned

Qualifications:

- Medical terminology preferred

- Detail-oriented

- Able to work independently, but receive direction from team members

- Communicate efficiently both internally and externally

- Compassionate

- Critical thinking

Interested in applying? Click here.

We're currently hiring claims analysts.

Leads Representatives

Our leads team is built with dynamic, analytical, and creative team members. As a member of the leads department, individuals will be responsible for generating leads through direct mail, Facebook and commercials as well as tracking data, communicating with agents and outside vendors, and distributing leads to our agent base. This role allows a candidate the opportunity to grow in the industry as well as learn new skills such as marketing and data-analytics.

Job Type: Full Time

Responsibilities:

- Communicate both internally and externally

- Efficient in Excel

- Process data

- Ability to work on individual projects as well as work within a team

- Monitor the lead inventory to ensure data is correct

- Process payments and understand basic

- Accounting Functions

- Other job duties as assigned

Qualifications:

- Excellent communication skills

- Ability to multi-task

- Detail-oriented

- Ability to work in a fast-paced and high-volume department

- Ability to work independently, but also with a team if needed

- Computer proficiency

Interested in applying? Click here.

We're currently hiring direct sales representatives.

Direct Sales Representatives

As an agent of Senior Life Insurance Company, you will have the privilege of helping families. We help our clients enroll in a life insurance policy that will help their families with the individuals’ final expenses. Our policyholders are also eligible to enroll into a membership with Legacy negotiate costs at the time of need. Direct Sales Agents work hard to ensure that families are financially secure during the most difficult time of a loved one’s life. We are passionate about helping and welcome the opportunity to grow our agent field to help more individuals nationwide.

Job Type: Full Time

Responsibilities:

- Make inbound and outbound calls daily

- Communicate efficiently both internally and externally

- Ability to meet or exceed sales goals

- Understand and promote company programs

- Prepare and submit sales contracts

- Maintain client records

- Other job duties as assigned

Qualifications:

- Experience in sales preferred but not necessary

- Ability to work comfortably in a fast-paced environment

- Excellent communication skills

- A commitment to customer service

- Ability to quickly build rapport with clients

Interested in applying? Click here.

Our Core Values •Our core values dictate every aspect of our business.

F

Focus

We are focused on the things that matter.

We never spend time or energy worrying about things that don’t either get us closer to our goals or help us accomplish our objectives. Our objectives are to help families by offering affordable final expense products and to build up agents to be as successful as possible.

A

Adaptability

We are flexible and collaborative, always keeping the end result in mind.

We believe just because something has always been done a certain way, that doesn’t mean it’s the best way. As a company we are always looking for new ways to innovate and solve problems so we can continue to work towards our desired results.

M

Morality

We operate at the highest moral standards.

As a company, and as individuals, we strive to operate at the highest moral standards. In our business, we work hard to do right by the families we serve. As individuals, we treat others the way we would want to be treated – with kindness and respect. We believe no matter what you accomplish in business, or in life, what truly matters is how you treat the people around you.

I

Intentionality

We are aggressively intentional, determined, passionate, disciplined, dedicated and relentless in every pursuit, every day.

Whether it is the products we offer, the tools we give our agents, or the way we work with one another, we are always intentional about our decisions and our direction. Everything we do has a purpose, because we believe we must focus on doing work that matters in order to accomplish our goals of helping families and building leaders.”

L

Leadership

We lead by example with humility, through relationship, honesty and boldness.

At Senior Life, we believe leadership is everything. We build leaders in every capacity here, and we do it through humility, through relationship, with honesty and with boldness.

Y

Yearning

We yearn to serve, to inspire and to supersede our mission and goals.

This value speaks to our constant drive to achieve all our goals, meet all our standards, and go above and beyond what is expected. In business, you always need to have to have something that motivates you. In business, motivation is crucial.

CONTACT US

CONTACT US LEARN MORE

LEARN MORE